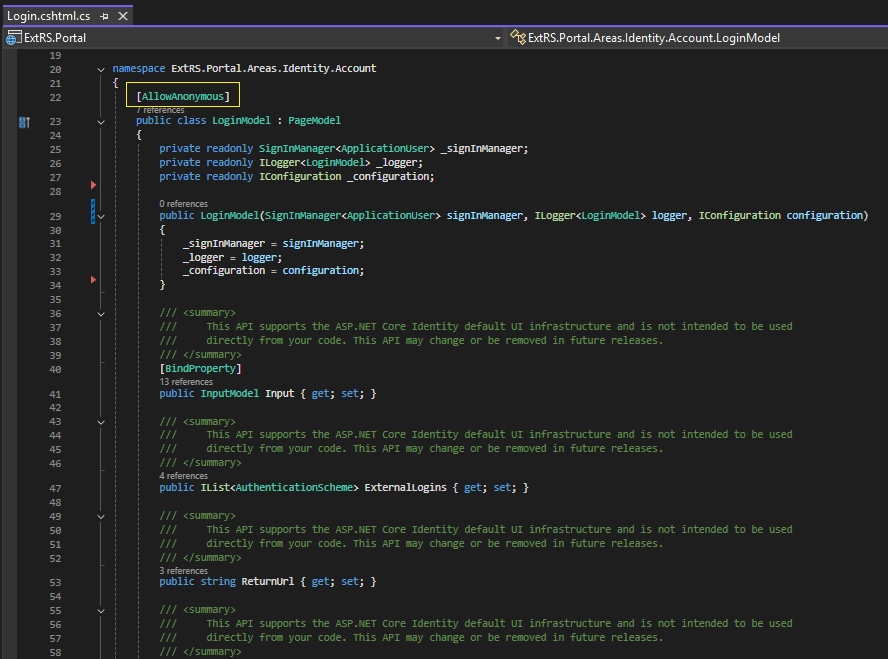

@model ReportView

<script>

</script>

<div class="container" style="background-color:#ffffff">

<section>

<div style="background-color:#ffffff; box-shadow: 5px 10px 8px #888888;">

<iframe height="800" width="900" src="@Model.SelectedReport.Uri" class="body-box-shadow"></iframe>

</div>

</section>

</div>

<script src="https://code.highcharts.com/highcharts.js"></script>

<script src="https://code.highcharts.com/themes/adaptive.js"></script>

<head>

<script>

$(document).ready(function () {

Highcharts.seriesTypes.line.prototype.getPointSpline = Highcharts.seriesTypes.spline.prototype.getPointSpline;

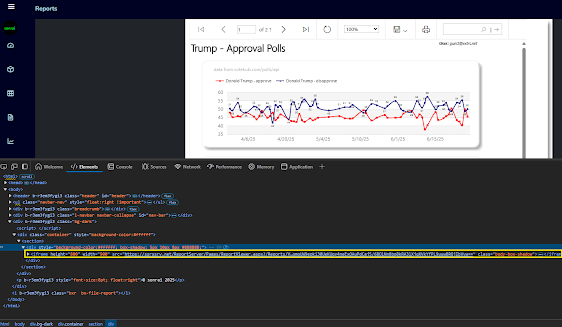

Highcharts.chart('potusApproval', {

title: {

text: 'Trump Job Approval',

align: 'left'

},

subtitle: {

text: 'Source: <a href="https://api.votehub.com/polls?poll_type=approval&subject=Trump" target="_blank">VoteHub</a>.',

align: 'left'

},

yAxis: {

title: {

text: 'Approval'

}

},

legend: {

layout: 'vertical',

align: 'right',

verticalAlign: 'middle'

},

plotOptions: {

area: {

pointStart: '1/1/2025',

relativeXValue: false,

marker: {

enabled: true,

symbol: 'circle',

radius: 2,

states: {

hover: {

enabled: true

}

}

}

}

},

series: [{

name: 'Approve',

data: [ @string.Join(", ", Model.HighChartsModel.Approves) ]

}, {

name: 'Disapprove',

data: [ @string.Join(", ", Model.HighChartsModel.Disapproves) ]

}],

});

});

</script>

</head>

<table style="width: 100%; height:50%">

<tr><td><div id="potusApproval"></div></td></tr>

</table>

<iframe title="PBI_Report" style="width:100%; height:73%" src="https://app.powerbi.com/reportEmbed?reportId=695fe0f1-5c9e-497d-8913-e59f0b939ac4&autoAuth=true&embeddedDemo=true" frameborder="0" allowFullScreen="true"></iframe>

Reference: https://learn.microsoft.com/en-us/power-bi/developer/

Source: https://github.com/sonrai-LLC/extRS/tree/main/ExtRS.Portal | https://extrs.net